PAST PROJECTS

Legacy Group Track Record

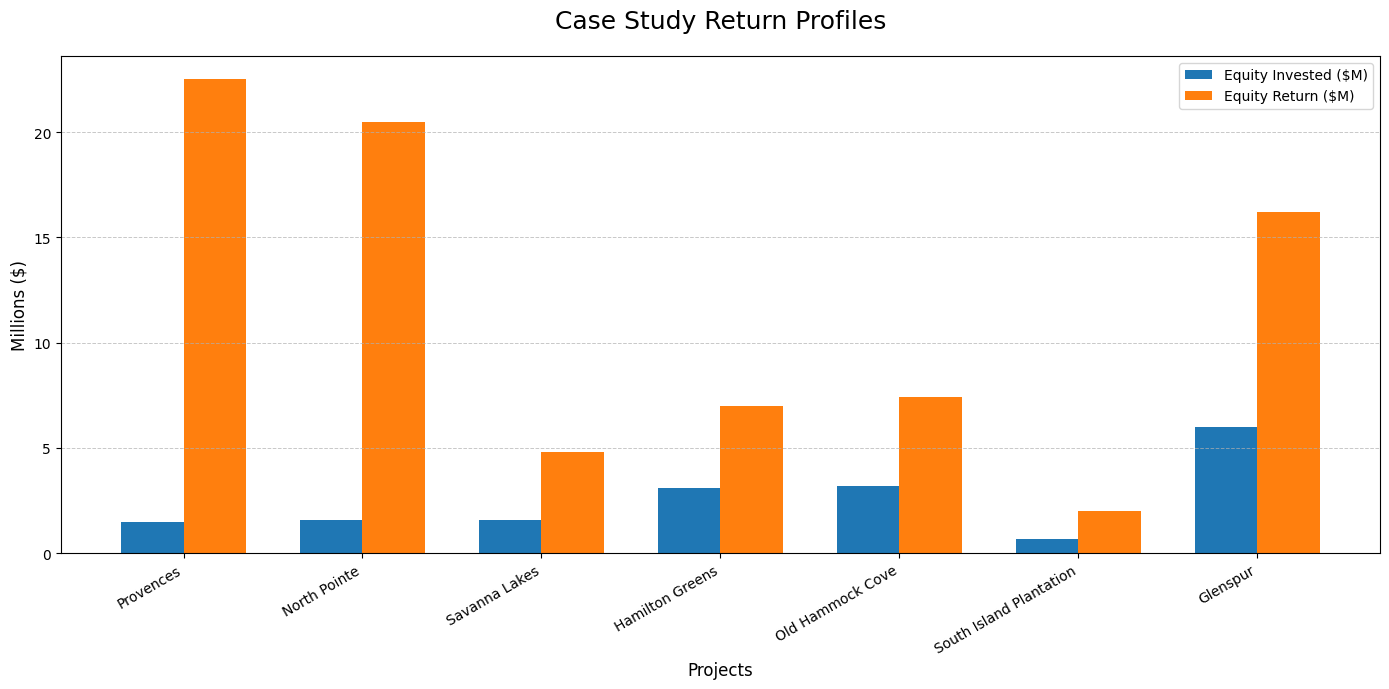

Through a series of affiliated entities, Legacy Group acquired seven strategically located properties in Florida at favorable valuations. The Principals successfully advanced entitlements as planned, driving a substantial increase in asset value.

Acquisitions: Seven properties acquired for a combined $48.8 million.

Capital Deployed: $41.4 million invested in land payments, development, and entitlement costs.

Value Creation: Post-entitlement value reached approximately $193.0 million.

Investor Performance: $20.2 million of equity generated $80.6 million in total profits, including $49.4 million in property value and $31.2 million in cash distributions.

Returns: Weighted average IRR of ~81% and a weighted average equity multiple of ~4.2x.

Today, these projects stand as a clear demonstration of Legacy Group’s ability to source well-positioned properties, execute entitlement strategies, and deliver outsized returns while managing risk responsibly.

PROVENCES - PORT ST. LUCIE, FLORIDA

Equity Investment: $1.5 million

Equity Return: $22.8 million

Equity IRR: 354.3%

Equity Multiple: 15.2x

Property

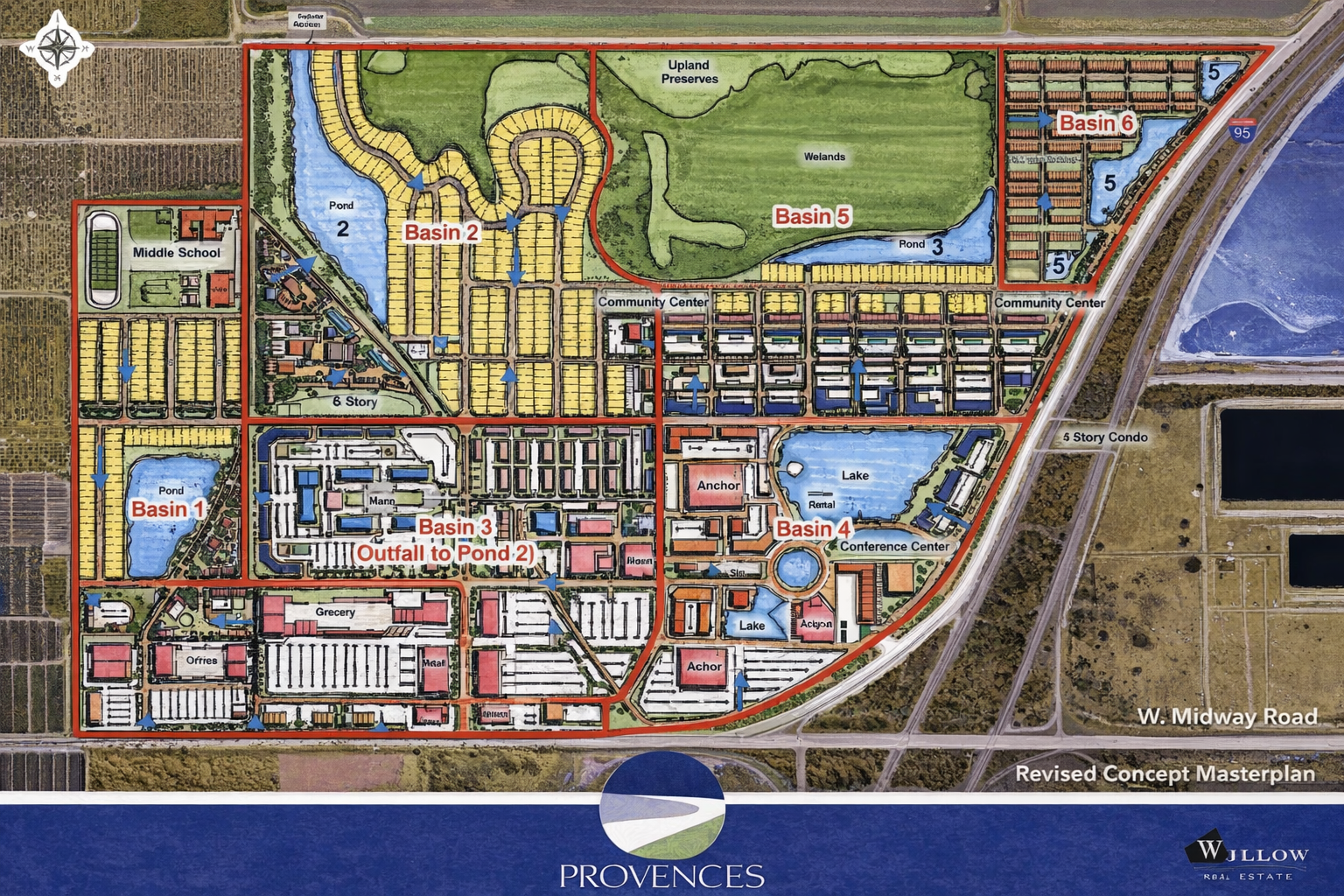

Provences was planned as a major mixed-use, master-planned community spanning 733 acres just North of another property developed by the Principals, North Pointe. Positioned at the Interstate 95 and Midway Road interchange in Port St. Lucie, Florida, the project was designed to include approximately 3,000 residential units and 2 million square feet of commercial space. The plan envisioned a 533-acre residential area and a 200-acre commercial “urban village,” anchored by a town center with a walking promenade along a 40-acre recreational lake. It further incorporated a one million square foot medical arts campus and biotech research center, a 350-room hotel and conference center, and a multi-plex movie theater.

Transaction

The Principals were drawn to Port St. Lucie for its exceptional growth potential and its proximity to West Palm Beach via I-95. Located immediately north of PGA Village, with its three high-quality, PGA-subsidized public golf courses, the area was already becoming a strong recreational and residential hub. At acquisition, Provences was raw land without entitlements, but the Principals recognized key advantages: its placement within the Urban Services Boundary, strong zoning flexibility, favorable land use designation, and highly attractive pricing.

The Principals were introduced to the long-time owner, a retired doctor, through a prior transaction. Building a strong relationship with him, they initially considered pursuing his vision for a golf driving range. After investing in early planning to demonstrate credibility, they persuaded him to support a larger vision of a master-planned community.

Through this relationship, the Principals secured excellent purchase terms: a $10.0 million price with only $1.5 million down, a deferred closing, and an interest-bearing note for the balance. They also arranged the sale of 200 acres to the South Florida Water Management District for $1.6 million, which provided capital for the down payment and early development. Additionally, the seller allowed them to place a $2.0 million mortgage on the property, further supporting the project’s financing.

The Principals advanced a master plan and invested approximately $3.2 million to secure entitlements and permits. They later sold 400 acres of the property’s remaining 600 acres to a regional builder for $25.0 million in cash, generating $12.0 million in profit after paying land costs and interest. This left the Principals with ownership of approximately 200 acres at the I-95 interchange, free and clear, with a fair market value estimated at $20.0 million. The property supported a $15.0 million line of credit, which was then used to fund operating costs and other investments.

Ultimately, the property was retained by prior equity partners, while Messrs. Bellinger and Hall maintained the rights to provide cable, telephone, security, and internet services at Provences.

2. NORTH POINTE - ST. LUCIE COUNTY, FLORIDA

Equity Investment: $4.1 million

Equity Return: $20.5 million

Equity IRR: 44.6%

Equity Multiple: 5.0x

Property

North Pointe was envisioned as a 2,000-acre master-planned community at the Interstate 95 and Midway Road interchange in Port St. Lucie, Florida. Situated immediately North of the PGA’s Florida headquarters and adjacent to three highly desirable PGA public golf courses, the property benefited from a prime location. It carried approvals for 4,000 residential units and 400,000 square feet of commercial space, positioning it as a major development opportunity.

Transaction

Building on their success with Provences, the Principals were attracted to North Pointe given its strategic location and adjacency to PGA Village. Due diligence revealed that the property required minimal additional entitlements and already had a Development of Regional Impact (DRI) approval for 4,000 residential units and 400,000 square feet of commercial space, requiring only limited modifications.

The Principals also learned that the property was owned by an association of wealthy individuals who had originally paid approximately $15 million. This group had been carrying the property’s expenses for many years, and when the Principals’ success at Provences established their credibility, the property manager approached them directly with an offer to sell North Pointe. The initial offering price was $25.0 million, equating to $6,250 per approved housing unit, each of which could ultimately retail for around $25,000. The Principals recognized this as an attractive opportunity and agreed to the price contingent on beneficial terms.

Through renegotiation, the Principals secured highly favorable terms: only $2.0 million down over seven years, no interest due until later in the term, and minimal takedowns of land as needed. Over the course of the transaction, the Principals invested approximately $1.5 million toward the land and an additional $2.6 million for entitlements and litigation costs. A lawsuit became necessary when the original sellers refused to close on the first takedown and attempted to claim default after realizing the Principals had increased the property’s value to approximately $75 million. The Principals prevailed in court, secured all necessary approvals including entitlements and PUD zoning, and completed the transaction.

Ultimately, the Principals, in cooperation with the landowners, sold the entire 2,000-acre property for $110.0 million in cash to a national homebuilder. The project delivered a 44.6% IRR and a 5.0x equity multiple. The North Pointe acquisition showcased the Principals’ ability to identify undervalued assets, structure transactions to minimize upfront capital, execute entitlement strategies, and achieve exceptional returns.

3. SAVANNA LAKES - ST. LUCIE COUNTY, FLORIDA

Equity Investment: $1.6 million

Equity Return: $4.7 million

Equity IRR: 81.5%

Equity Multiple: 2.9x

Property

Savanna Lakes was envisioned as a multi-family, mixed-use community on 126 acres along Highway 1, just South of Fort Pierce and close to the Atlantic Ocean. The project gained approval for 885 residential units and five acres of commercial property, and was located adjacent to an established golf course community. The site benefited from its prime coastal corridor location, frontage along Highway 1, and adjacency to both marshland and a successful residential development.

Transaction

The Principals discovered the site during an aerial survey of St. Lucie County, identifying it as one of the last undeveloped tracts in a growing coastal corridor. They soon learned that the property’s ownership group included a close friend of the former Provences landowner, along with other investors who were focused on different ventures. This created an opportunity for acquisition on favorable terms.

Due diligence revealed that the property’s Planned Unit Development (PUD) approval had expired, but could be renewed with minimal time and expense. After consultations with local officials and land planners, the Principals confirmed that entitlements could be reinstated efficiently. They were further attracted to the land’s unique density potential, allowing for nearly 900 homes on 126 acres, which positioned the project to accommodate attainable housing.

The Principals negotiated directly with the managing partner and ultimately agreed to a $1.3 million purchase price, structured with quarterly installment payments during the entitlement process. Public hearings for the PUD renewal generated substantial visibility, leading to immediate purchase interest. Shortly after the entitlements were reinstated, Mercedes Homes offered $10.0 million in cash for the property, an offer the Principals accepted. The transaction closed profitably, with only approximately $300,000 invested in permitting and entitlement costs, and the sale was completed before the scheduled closing date with the original seller.

The exit delivered an 81.5% IRR and a 2.9x multiple on equity. The Principals retained ownership of five acres of commercial land at Savanna Lakes, valued at approximately $1.0 million, along with long-term rights to provide cable, telephone, security, and internet services to the community.

4. HAMILTON GREENS - NAPLES, FLORIDA

Equity Investment: $3.1 million

Equity Return: $7.0 million

Equity IRR: 31.9%

Equity Multiple: 2.3x

Property

Hamilton Greens was planned as a luxury multi-family community of 87 residences situated on approximately 30 acres in Naples, Florida. The site occupied a high-growth corridor adjacent to a newly built county park on the East side of Livingston Road, between Immokalee Road and Vanderbilt Beach Road. Surrounded by some of the region’s most prestigious golf courses, including the Ritz-Carlton’s Tiburón Golf Club across the street, the property was designed as a private, gated community featuring three- and four-bedroom condominium homes in three-story buildings. Planned amenities included a clubhouse with swimming pool, spa, and fitness facilities.

Transaction

The Principals were contacted directly by a Naples realtor who anticipated strong market demand for the site. Already familiar with the surrounding area and its demographics, the Principals recognized the property’s unique potential in a submarket where approvals for new residential projects were extremely limited. They also knew that a new road was scheduled for construction in front of the site, which would enhance its accessibility and long-term value.

After inspecting the property, the Principals quickly secured it under contract at an asking price of approximately $4.0 million for 80–90 high-end units. In addition, they executed contracts for an adjacent parcel costing $1.25 million to secure private access, increase density, and further strengthen the project’s value.

Over the following entitlement process, the Principals invested approximately $1.0 million in permitting and approvals. They ultimately received unanimous approval for PUD zoning from Collier County’s Board of Commissioners. By the time approvals were complete, Livingston Road had been constructed as expected, transforming into a major North-South corridor just west of I-75 and enhancing the property’s market position.

The fair market value of Hamilton Greens at stabilization was estimated at $10 million, representing a 2.3x multiple and a 31.9% IRR. The property was retained by prior equity partners.

5. OLD HAMMOCK COVE - PALM COAST, FLORIDA

Equity Investment: $3.2 million

Equity Return: $7.4 million

Equity IRR: 32.2%

Equity Multiple: 2.3x

Property

Old Hammock Cove was envisioned as a private, gated, multi-family master-planned community of 136 units, including unique boathouse townhomes and condominiums, situated on 30 acres near the Intracoastal Waterway in Palm Coast, Florida. The property was bordered on three sides by a navigable canal with direct access to the Intracoastal Waterway. Many units were designed to be constructed directly on the water with integrated boat garages below, while others overlooked fairways of the adjacent Palm Harbor Golf Club. The property was also located near several additional golf clubs, including an oceanfront Jack Nicklaus Signature course. The community plan featured a clubhouse, swimming pool, spa, and fitness facilities.

Transaction

Palm Coast had become a rapidly growing area thanks to its location between Daytona and St. Augustine, ease of permitting, and high-profile developments such as the Nicklaus-designed oceanfront golf resort. The Principals recognized the property’s unique setting, strong entitlements, and the potential to deliver one of the most distinctive residential products in Florida with waterfront boathouse units. At the time of acquisition, the property was already approved for 250 units, adjacent to golf, and surrounded by an attractive forested landscape with canal frontage.

The Principals invested an additional $1.6 million in entitlement and permitting costs, engaging a top-tier legal and planning team to secure approvals. Initially, the project faced significant public resistance as citizens sought to slow the area’s explosive growth, and the city council rejected the development in an effort to set a new precedent on growth management. The Principals responded with an extensive community outreach effort, adjustments to the plan, and persistence in engaging local leadership. Ultimately, these efforts were rewarded with unanimous approval.

Final PUD zoning was granted for the project, which included one of the only plans for waterfront boathouse units in Florida. At stabilization, the land was valued at approximately $10.0 million, generating a 2.3x multiple and a 32.2% IRR. The Principals completed site planning and architectural design, and ultimately contributed the project to their prior investor group.

6. SOUTH ISLAND PLANTATION

HUTCHINSON ISLAND, ST. LUCIE COUNTY FLORIDA

Equity Investment: $0.7 million

Equity Return: $2.0 million

Equity IRR: 28.4%

Equity Multiple: 2.9x

Property

South Island Plantation is a five-acre parcel located directly across from the Atlantic Ocean on South Hutchinson Island in St. Lucie County, Florida. The site offered deeded beach access and proximity to an array of lifestyle amenities, including boating, fishing, golf, restaurants, and recreational facilities. With entitlements suitable for either multi-family or single-family homes, the property represented a rare opportunity in a desirable coastal market.

Transaction

The Principals became aware of South Island Plantation through networking, learning that the property could be acquired at a tax sale. Originally envisioned as the third phase of a high-rise condominium development, two towers of which had already been completed, the site had been abandoned by a major oil company that chose not to move forward with construction. The oil company confirmed it would not redeem the property or pay outstanding taxes, clearing the way for acquisition.

Market analysis and input from a local realtor revealed that the property already carried approvals for high-rise development and, alternatively, could support 25–30 townhomes or 12 single-family lots. The Principals purchased the land at tax sale for $500,000 and partnered with a trusted engineer, who agreed to lead entitlement efforts. An additional $200,000 was invested to secure land development permits for residential use.

After entitlements were finalized, the property’s fair market value increased to approximately $4.0 million, delivering a 2.9x equity multiple and a 28.4% IRR. Ownership of the property was structured as a 50-50 partnership with the engineer, who was granted operational control. While South Island Plantation is not intended to be contributed to the Fund, the Principals continue to hold this asset..

7. GLENSPUR - WELLINGTON, FLORIDA

Equity Investment: $6.0 million

Equity Return: $16.2 million

Equity IRR: 53.3%

Equity Multiple: 2.7x

Property

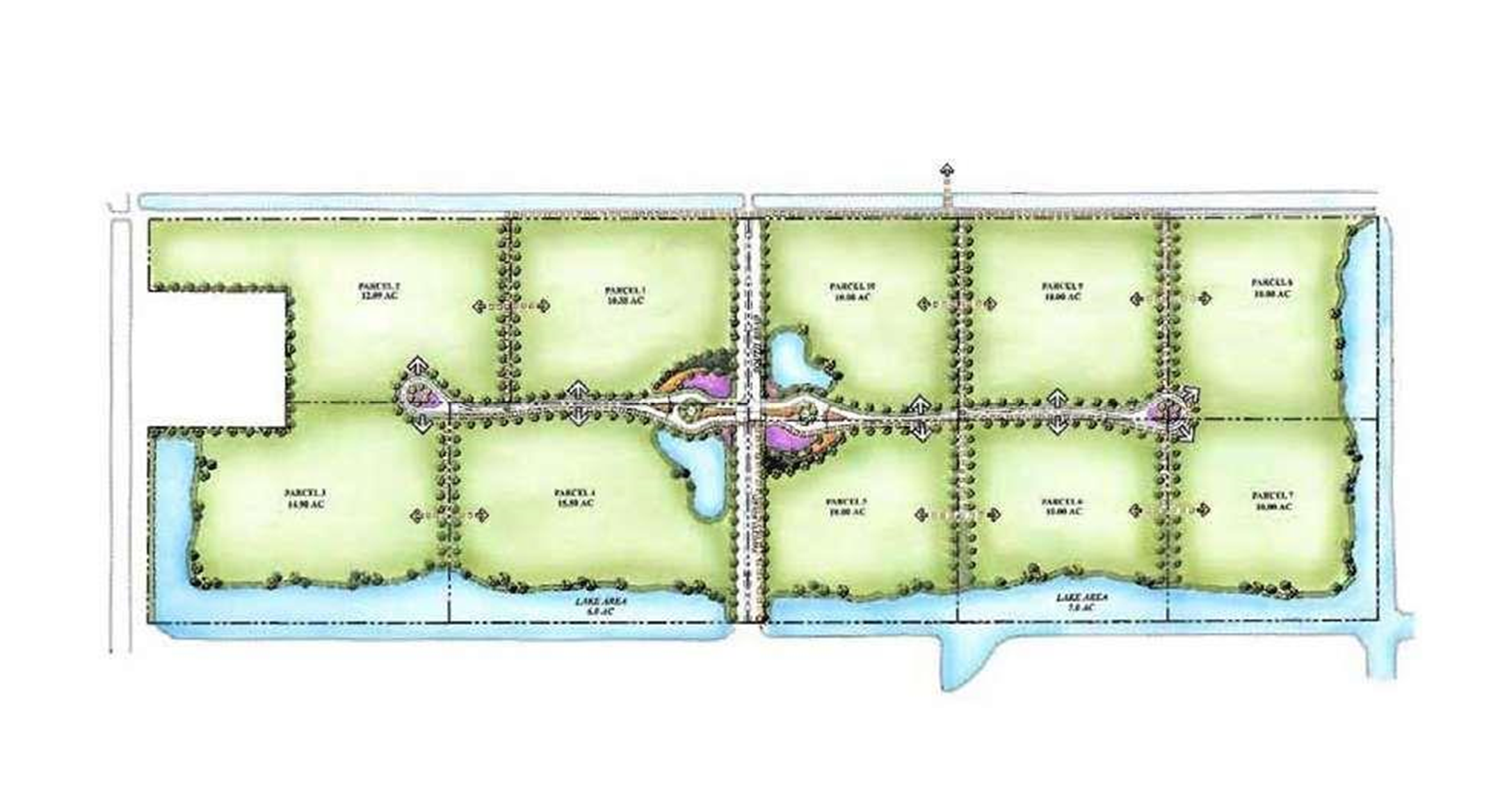

Glenspur was a 112-acre private community in Wellington, Florida, designed for equestrian living. The plan featured ten lots ranging from 10 to 15 acres, each dedicated exclusively to competitive and recreational equestrian pursuits. The property was uniquely positioned within one block of Wellington’s world-renowned Grand Prix show grounds, an international center for equestrian events that attracts top riders from across the globe.

The land offered some of the most desirable farm property in the region, with zoning that allowed for private or commercial stables, paddocks, riding rings, and residential dwellings suitable for owners, groundskeepers, or trainers. A private bridle path connected the property directly to the show grounds, enabling owners to walk their horses rather than haul them in trailers, an amenity virtually unmatched in the market.

Transaction

The Principals had long identified Wellington as a premier equestrian destination but had been hesitant to pursue acquisitions due to extraordinarily high land costs, often ten times the value of properties just outside the central horse grounds. They had previously attempted to acquire Glenspur but were unsuccessful. An opportunity arose years later when the property became available following the original owner’s passing.

A trusted local realtor notified the Principals that Glenspur could potentially be acquired for approximately $14.0 million, well below their estimate of fair market value. Several interested parties competed for the property, but the Principals secured the deal by quickly committing to the purchase and paying the required $500,000 deposit on a $14.4 million price.

Due diligence confirmed that Glenspur was still fully entitled for 10-acre lots and required only site plan approval to deliver ten high-end equestrian estates ready for development, a rarity so close to the show grounds. The Principals invested approximately $1.2 million to advance entitlements and secure approvals. Although the approval process was lengthy due to Wellington’s restrictive building environment, they ultimately obtained full site plan approval for the community.

At stabilization, the property was valued at approximately $28.0 million, delivering a 2.7x multiple and a 53.3% IRR. Glenspur was retained by the Principals’ prior investor partners.